UNDERSTANDING

Your tax bill

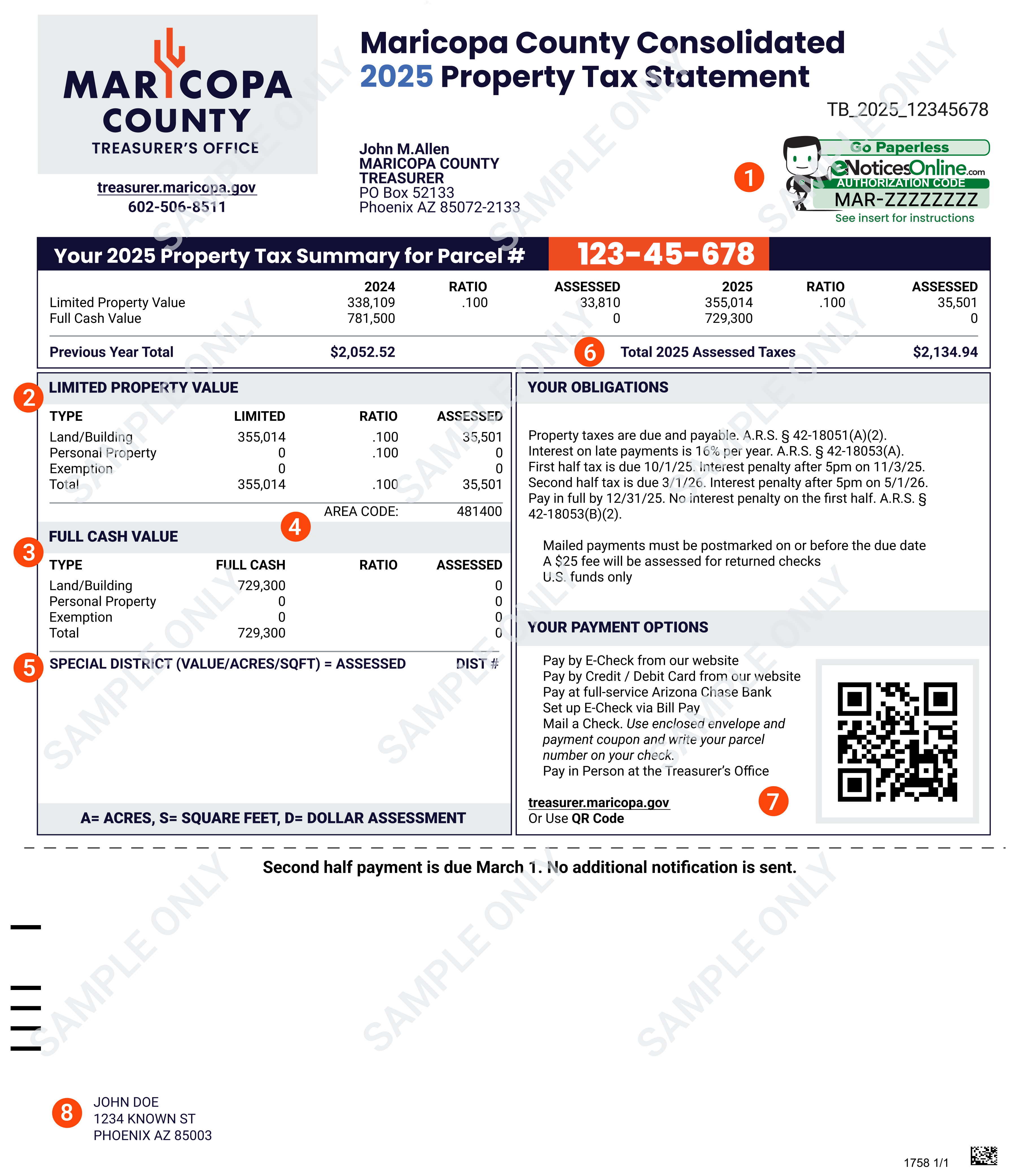

Understanding your tax bill

- 1. eNotices Authorization Code

Please see insert "How to set up your eNoticesOnline account."

- 2. Limited Property Value

Limited Value is a figure determined by mathematical computations provided for in statute. This area explains the property, shows the property limited value, shows the property classification percentage, and shows the limited assessed value. The limited assessed value is figured by multiplying the limited value by the ratio.

- 3. Full Cash Value

Full Cash Value represents the Assessor's approximate market value.

- 4. Area Code

Assessor-assigned code that represents the sub-political jurisdiction that receives the tax dollars. The first two digits represent the school district, the next two digits represent the city or town, and the last two digits represent special districts.

- 5. Special District

These districts are authorized by statute and approved by the local voter's government to provide specific services to the taxed individual. The assessments for these special districts are not always calculated on the values of the property. They can be based on the value in acreage, value in dollars, or value in frontage square feet.

- 6. Total 2025 Assessed Taxes

Total tax assessed for the property tax year.

- 7. QR (Quick Response) Code

Scannable barcode link for the Maricopa County Treasurer's website, Treasurer.Maricopa.Gov.

- 8. Address Block

The mailing address is usually obtained from the Assessor's Office, who in turn receives the information from the Deed or Affidavit of Value recorded with the Recorder's Office. The mailing address may be different from the situs address.

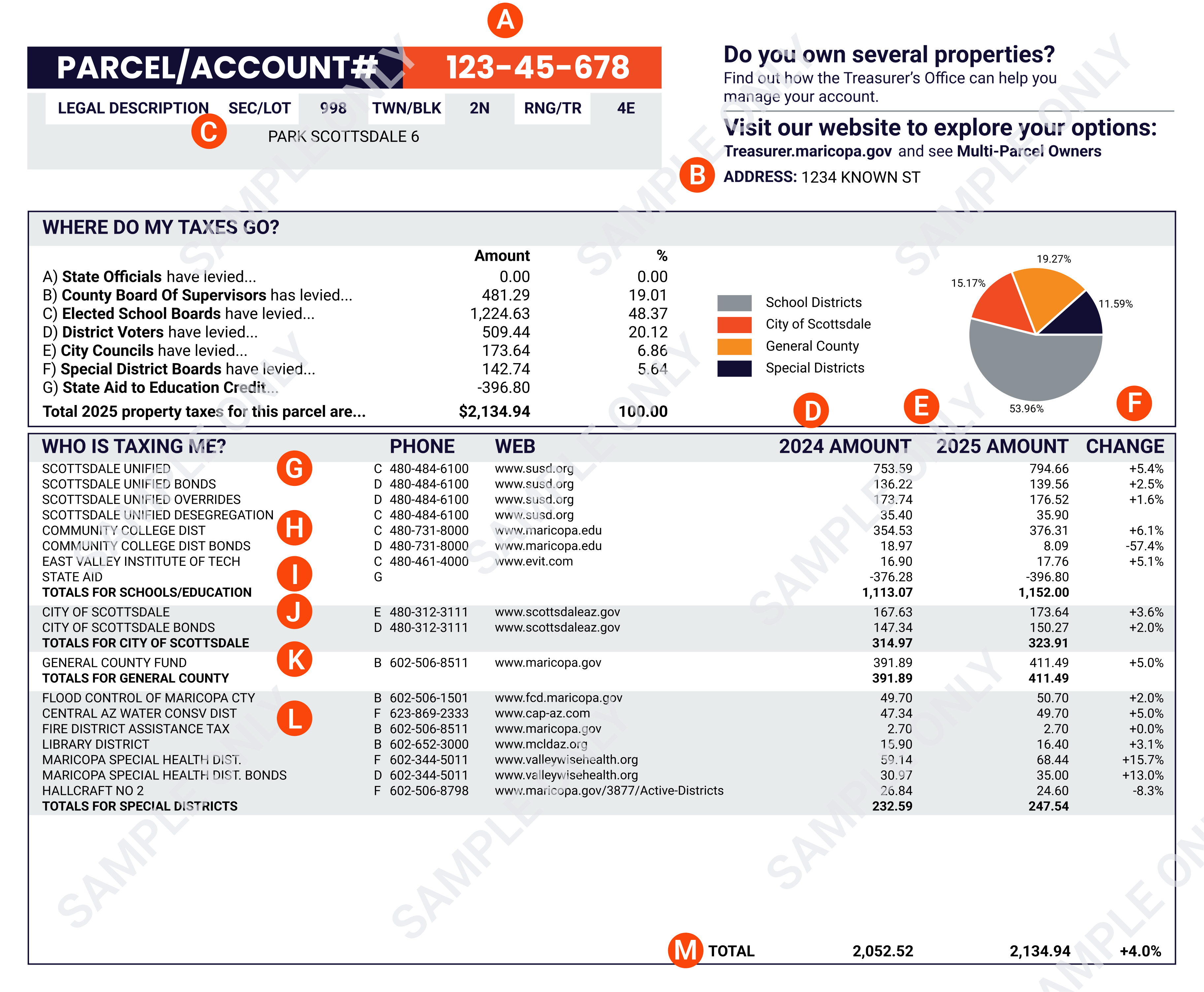

- A. Parcel/Account #

The parcel number identifies the subject property, or land parcel, for tax purposes. The number is composed of the book, map, and parcel number as defined by the Maricopa County Assessor's Office.

- B. Property Address

According to the Maricopa County Assessor’s Office, this is the physical location of the property being represented by this bill.

- C. Legal Description

Description of real property sufficient to locate it on the ground by reference to surveys or approved recorded maps.

- D. Previous Year Comparison

This column lists the amount of tax for the previous year.

- E. Current Year Tax Distribution

This column is the breakdown of the current taxes. It shows the tax rate for every $100 of assessed value and the total tax for each jurisdiction. The taxes can be figured by dividing the limited net assessed value by 100. Then multiply that amount by the tax rate.

- F. Percentage Change

This represents the difference between the current year’s assessment and the prior year’s assessment, as defined in the form of a percentage.

G.

- School District:

Your local school district assesses tax for maintenance and operations and capital outlay.

- School Bonds:

A voter-approved tax required to pay for the debt service for city, county, and school bond projects.

- School Overrides:

A tax that has been approved by voters in prior years to exceed the operating budget. Voter overrides may last up to three years unless an additional override is subsequently approved by public vote.

- School Desegregation:

A tax that has been legislated to provide funding for school desegregation at the district level.

- H. Community College Dist

This tax is levied for the maintenance and operations of the Maricopa County Community College District.

- Community College Dist Bonds:

A voter-approved tax required to pay for the debt serive for community college and school bond projects.

- State Equalization Tax:

County equalization assistance for education.

- I. State Aid

State Aid to Education is given on residential property for school district tax rates.

- J. City Tax

If your city has enacted a property tax for operations, it is shown here.

- K. General County Fund

Taxes to support the primary County operating account that provides funds for the delivery of services to Maricopa County citizens.

- L. Flood Control of Maricopa Cty:

The Board of Supervisors authorizes a county-wide tax for the construction of flood control projects within Maricopa County.

- Central AZ Water Consv Dist:

A county-wide tax for both the operations of the districts and a water storage fund.

- County Library:

This district collects taxes for the main County library, community branches, and contributes to a county-wide library loan program with other city libraries.

- Fire District Assistance Tax:

A county-wide tax levied by the Board of Supervisors to supplement the local volunteer fire districts tax levies for community fire districts.

- County Health Care District:

This is a county-wide taxing jurisdiction that was created by the voters to provide supplemental funding for Maricopa Integrated Health Services.

- M. Grand Total

Total Current Tax Due. This shows the total current assessed tax amount for the property tax year.